Buying a home often means taking on a mortgage, and with that comes the concept of amortization. While the word itself may sound technical, amortization is simply the process of paying off your loan in regular installments over time. An amortization schedule is the roadmap that shows exactly how each monthly payment is divided between interest and principal.

For homeowners, understanding this schedule is more than just a math exercise—it helps you see how your mortgage balance shrinks, how much interest you’ll pay over the life of the loan, and how you might save thousands by making strategic choices along the way.

What Is Amortization?

Amortization is the structured repayment of a loan through regular payments that cover both the interest owed and a portion of the principal balance. With each monthly payment, your loan balance gets smaller. In the early years of a mortgage, most of your payment goes toward interest, but over time the balance shifts, and more goes toward paying down your principal.

This predictable structure is designed to fully pay off the loan by the end of the term, whether it’s 15, 20, or 30 years.

What Is an Amortization Schedule?

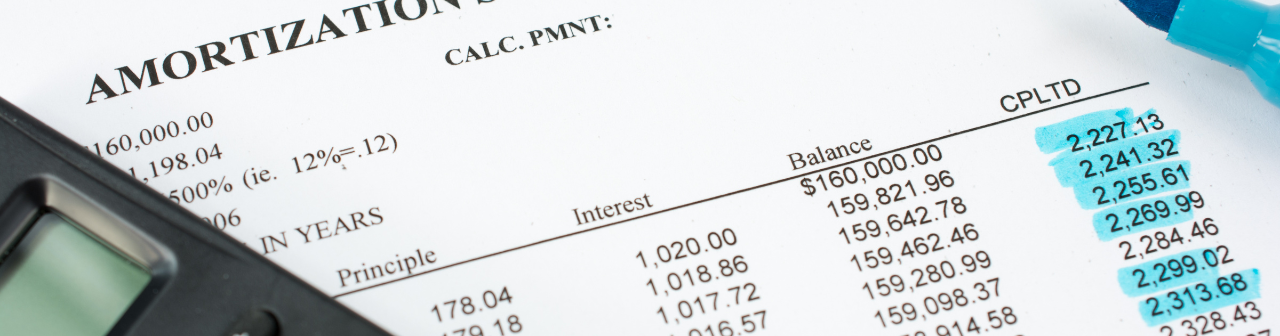

An amortization schedule is a detailed table that outlines every payment you’ll make on your mortgage, month by month, from the first to the last. It shows three key components of each payment:

- Principal – The portion that reduces your loan balance.

- Interest – The lender’s charge for borrowing the money.

- Remaining Balance – How much you still owe after that month’s payment.

This schedule is essentially your financial blueprint, giving you a clear picture of how your mortgage will play out over the years.

How Mortgage Payments Are Structured

Let’s break down what happens inside a single monthly payment.

Imagine you have a $300,000 loan with a 30-year term at a fixed rate of 6%. Your monthly principal and interest payment would be about $1,799.

- Month 1: Roughly $1,500 of that payment goes to interest, and only about $299 chips away at the principal.

- Year 15: The ratio starts to shift. Around half your payment goes toward principal and half to interest.

- Final Year: The bulk of your payment goes directly to reducing the principal, with only a small portion covering interest.

This shift happens automatically, built into the amortization formula.

Why Amortization Matters

Understanding your amortization schedule has real-world benefits.

- Transparency: You see exactly how much interest you’ll pay over time.

- Planning: You can estimate when your balance will reach a certain point—for example, when you’ll have 20% equity and can drop PMI (if applicable).

- Savings Opportunities: You can calculate how much you’d save by making extra payments or refinancing into a lower rate.

At CapCenter, our clients often use amortization schedules to explore “what-if” scenarios—like how an extra $200 a month could shave years off their loan and tens of thousands off total interest.

Example of a 30-Year Amortization Schedule

Let’s look at the same $300,000 loan at 6% interest.

- Total Interest Paid Over 30 Years: About $347,500—more than the original loan amount.

- Total Cost of Loan (Principal + Interest): Around $647,500.

This is why homeowners often look to refinance when rates drop. Even a small reduction in rate can dramatically cut lifetime interest, especially in the early years when interest makes up most of your payments.

Fixed vs. Adjustable-Rate Mortgages

Your amortization schedule will look different depending on your loan type.

- Fixed-Rate Mortgage: Payments remain predictable for the entire term, making it easy to track amortization.

- Adjustable-Rate Mortgage (ARM): Payments may start lower, but once the rate adjusts, your amortization schedule resets based on the new interest rate, changing the balance between interest and principal.

CapCenter clients often use our mortgage calculator to compare fixed and adjustable-rate options side by side.

How Extra Payments Impact Amortization

Here’s where understanding the schedule pays off.

If you make just one extra principal payment of $1,799 each year on that $300,000 loan, you could cut the loan term by about 4 years and save more than $47,000 in interest.

If you add $200 extra per month, you could shave nearly 8 years off your loan and save over $90,000 in interest.

Your amortization schedule makes these potential savings visible.

Using Amortization Schedules for Financial Planning

Beyond understanding your mortgage, amortization schedules help you:

- Track Home Equity Growth: As you pay down principal, your equity increases, boosting your net worth.

- Time Refinances Strategically: Knowing how much interest you still owe can clarify whether refinancing makes sense.

- Plan for Life Changes: Whether you expect to sell in 7 years or pay off early, your schedule helps you estimate financial outcomes.

CapCenter’s Mortgage Calculator and Home Value Estimate Tool make it easy to explore these scenarios without guesswork.

Common Questions About Amortization

Do all mortgages have an amortization schedule?

Yes, almost all fixed and adjustable-rate mortgages use amortization. The schedule just looks different depending on your term and rate.

Can I get an amortization schedule for my existing loan?

Absolutely. Most lenders can provide one, and you can also generate it using online calculators.

What happens if I refinance?

Refinancing essentially resets your amortization schedule. While your balance carries over, the new rate and term will change how payments are structured going forward.

Does making biweekly payments help?

Yes. Biweekly payments mean you make 26 half-payments a year—effectively one extra full payment annually. This can reduce your term and total interest significantly.

The CapCenter Advantage

At CapCenter, we believe homeowners should know exactly where their money is going. That’s why we not only provide clarity around amortization schedules but also remove a major cost hurdle: Zero Closing Costs.

By eliminating traditional closing costs, we help clients save thousands upfront and keep their long-term mortgage strategy flexible. Whether you’re buying your first home or considering a refinance, our team walks you through the numbers so you can make confident decisions.

Explore your loan scenarios today with our Mortgage Calculator and see how CapCenter’s Zero Closing Cost model can save you more.

Final Thoughts

An amortization schedule isn’t just a financial table—it’s the story of your mortgage, showing how your payments build equity and reduce debt over time. By understanding how it works, you gain control over one of the largest financial commitments you’ll make in your life.

With CapCenter’s guidance, tools, and Zero Closing Cost mortgages, you can turn that schedule into a strategy that saves money and accelerates your path to financial freedom.